japan corporate tax rate 2018

Corporate income tax rate 6 6 Year 22 Layout. 10 of the increased salary payment plus.

Real Estate Related Taxes And Fees In Japan

Japan Corporate Tax Rate History.

. Home 2018 corporate rate tax. Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018. 55 of taxable income.

5 rows Corporation tax rate 1 April 2016. Income from 0 to 1950000. In the case that a corporation amends a tax return and tax liabilities voluntarily.

Income from 3300001 to 6950000. Special local corporate tax rate is 4142 percent which is imposed on taxable income multiplied by the standard of. Read more about At 483 in 2018 corporate taxes in India among highest in the world on Business Standard.

338 Treatment of losses. The 2018 Japan Tax Reforms include the following changes to Japanese individual income tax. Income from 0 to 1950000.

And 31 March 2018 Tax rates for companies with stated capital of JPY 100 million or greater are as follows. Tax year beginning between 1 Apr 201731 Mar 2018. However the tax rate increase has created a.

The current rate 10 will apply up to gross. An under-payment penalty is imposed at 10 to 15 of additional tax due. Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated.

14 14 Taxable Year of Companies. Large corporations with capital over 100 millionapproximately 1 percent of all corporations in Japanface an overall CIT rate of around 356 percent in the Tokyo area and 345 in areas applying the standard local rate. A Look at the Markets.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. The consumption tax rate to 10 which includes a 22 local consumption tax as well as the. Income from 9000001 to 18000000.

Corporation tax is payable at 234. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. Japan Income Tax Tables in 2020.

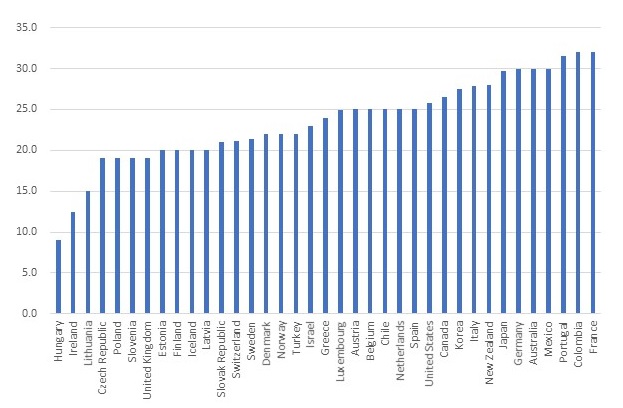

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. The combined corporate tax rate in India is more than one-and-a-half times that of Japan and over double that of Russia and the UK. Government at a Glance.

Administrative burdens could be very large compared to large-sized business. 15 15 Taxable Income. Currency Rate In Pakistan Us Dollar Saudi Riyal Uk Pound Uae Dirham 28 December 2018 Business Thenews Com Pk Dollar Currency Symbol Canadian Dollar.

Japan Income Tax Tables in 2018. Dollar posts weekly gain. Details of Tax Revenue Korea.

Effective Statutory Corporate Income Tax Rate. The rate is increased to 10 to 15 once the tax audit notice is received. Income from 6950001 to 9000000.

1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax. Product Market Regulation 2018. Tax year beginning after 1 Apr 2018.

Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. 50 of taxable income. Overview of the Consumption Tax System in Japan - May 2018 Yasutaka Nishikori Nishimura Asahi 1 Historical Background.

Tax rates for companies with stated capital of more than JPY 100 million are as follows. Local management is not required. However if the taxable earnings exceed this amount a rate of 15 is charged on the amount in excess of 30 million yen and up to 100 million yen and any amount in excess of 100 million yen is taxed at a rate of 20.

Paid-in capital of over 100 million. Tax year beginning between 1 Apr 201631 Mar 2017. Details of Tax Revenue Japan.

Details of Tax Revenue - Latvia. 15F 2-5 Kasumigaseki 3-chome Chiyoda-ku Tokyo 100-6015. 15 of increased salary payment 20 if training costs have increased by 20 or more Limitation on tax credit.

Local corporation tax applies at 44 on the corporation tax payable. PwC Tax Japan Kasumigaseki Bldg. But if the company is Medium and small sized company the taxable income limitation does not apply.

2 of the salary payment made in the preceding year. 60 of taxable income. Income from 1950001 to 3300000.

For a deeper discussion of how this issue might affect your business please contact. Japan corporate tax rate 2018 Saturday February 19 2022 Edit. If the annual taxable earnings do not exceed 30 million yen it is subject to a tax rate of 10.

Our company registration advisors in Japan can deliver more details related to the corporate tax in this country. New principal hub companies will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. Regulation in Network and Service Sectors 2018.

The corporate tax rate in Japan for a branch is the same as for a subsidiary. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Up to 10 of the corporate tax liability Up to 20 of the corporate tax liability. Benchmark Treasury yield hits 3-yr high.

Opinion This Is Tax Evasion Plain And Simple The New York Times

Digital Companies And Their Fair Share Of Taxes Myths And Misconceptions

Real Estate Related Taxes And Fees In Japan

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

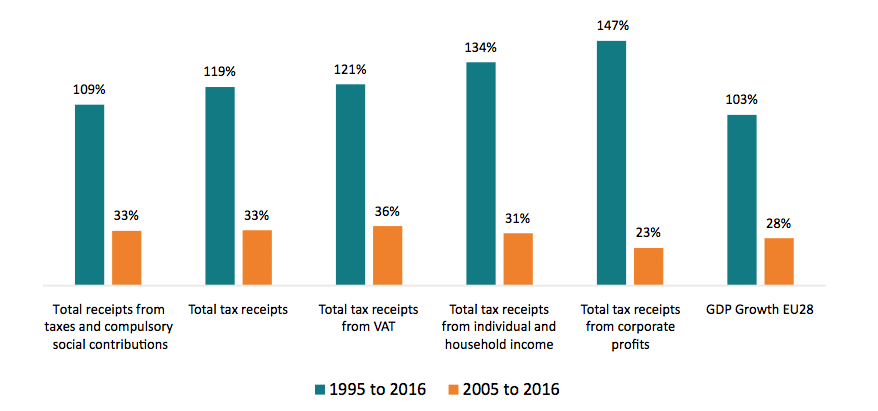

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Japan Consumer Price Index Cpi Statista

Tax Brackets 2018 How Trump S Tax Plan Will Affect You

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

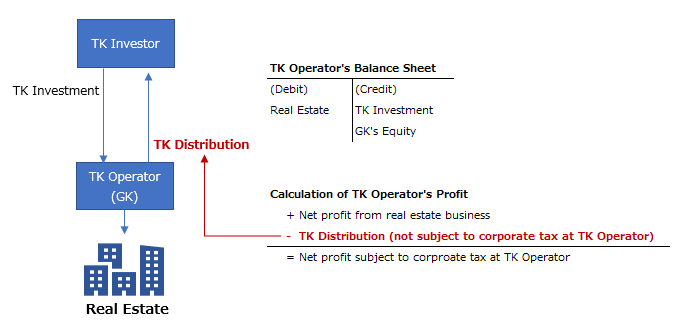

Taxation Of Tokumei Kumiai Investment Suga Professional Tax Services

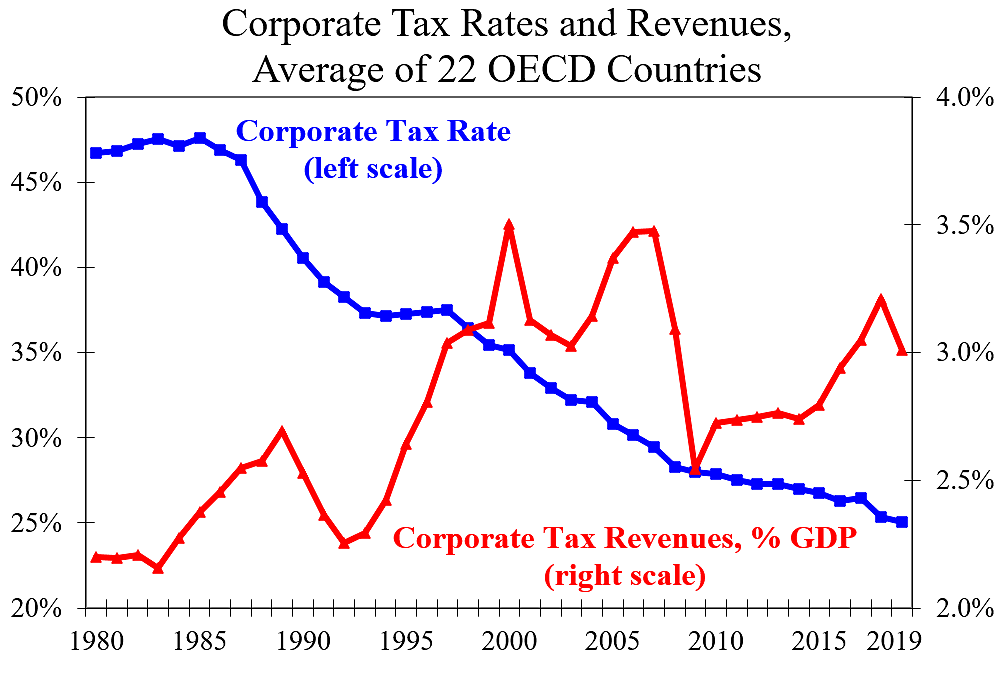

Be Cautious About Raising The Corporation Tax Rate Oxford University Centre For Business Taxation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

Do Existing Tax Incentives Increase Homeownership Tax Policy Center

Corporate Tax Reform In The Wake Of The Pandemic Itep

Doing Business In The United States Federal Tax Issues Pwc

Profitable Giants Like Amazon Pay 0 In Corporate Taxes Some Voters Are Sick Of It The New York Times