postmates tax form online

The business part of your Federal tax return is form Schedule C. If you earned more than 600 youll receive a 1099.

Postmates 1099 Taxes The Last Guide You Ll Ever Need

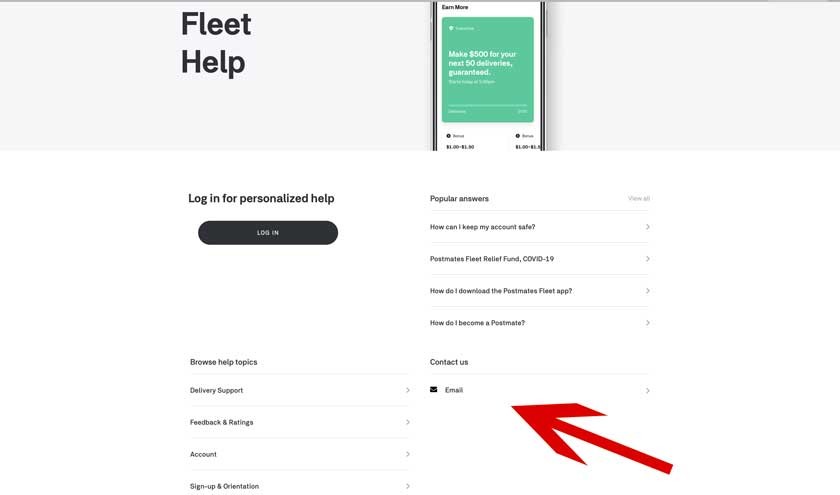

Get help in the app.

. Typically you should receive your 1099 form before January 31 2021. This is where you report your income for the last year. Get Your Maximum Refund With TurboTax.

File Your Federal And State Taxes Online For Free. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. You can update your address here if you need to.

Ad Free software fills out tax forms IRS free file program participant. Postmates will send you this form if you made over 600 in a year. Since taxes arent withheld from your Postmates income its possible you need to pay taxes quarterly.

You can make many deductions through your work effectively reducing your. Just head to Help in the Uber app navigation. Postmates Tax Form 1099.

Couriers may also contract to perform services for other delivery companies. IRS Tax Forms For A Postmates Independent Contractor. Getting the form is the easy part.

The standard mileage rate for 2017 is 535 cents per mile and its calculated to include the average cost of gas car payments car insurance maintenance and other vehicle expenses. As a Postmates delivery driver youll receive a 1099 form. Follow us on Twitter.

Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. How to Get 1099 from Postmates. Its also where you report your business expenses.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. Get the latest status on the app or tweet to us with any questions you have.

Read on for more details. Here is the link youll need to request a 1099 from Postmates. Here is a roundup of the forms required.

Americas 1 tax preparation provider. Postmates will send you a 1099-NEC form to report income you made working with the company. DoorDash dashers who earned more than 600 in the.

You pay 153 SE tax on 9235 of your Net. While Stride operates separately from Postmates I can tell you that Postmates will only prepare a. DoorDash dashers will need a few tax forms to complete their taxes.

I can no longer go online in my Postmates Fleet app. The witness testified that employees of Postmates receive W-2 tax forms and are paid biweekly in. This means that if you work for Postmates you have to track your own taxes.

Get Your Max Refund Today. The best way to figure out if you owe quarterly taxes is to fill out Form. When to file Postmates 1099 taxes.

A 1099 form is an information return that shows how much you were paid. If you are expected to owe the IRS 1000 or more when you file taxes then you need to make quarterly estimated income payments. As a Postmates independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filings.

Postmates has joined Uber Eats which means customers and delivery requests have switched to the Uber app as of June. IRA Tax Forms for All Types of Less - Used Tax Forms.

How To Get Your 1099 Form From Postmates

Postmates Customer Service 3 Ways To Contact Postmates Support

How To Get Your 1099 Form From Postmates

4 Easy Ways To Contact Postmates Driver Customer Support

Postmates 1099 Taxes The Last Guide You Ll Ever Need

The Ultimate Guide To Taxes For Postmates Stride Blog

.png)

Postmates 1099 Taxes The Last Guide You Ll Ever Need